This article will guide on how to implement this tax slab to the pharmacy from CPH side.

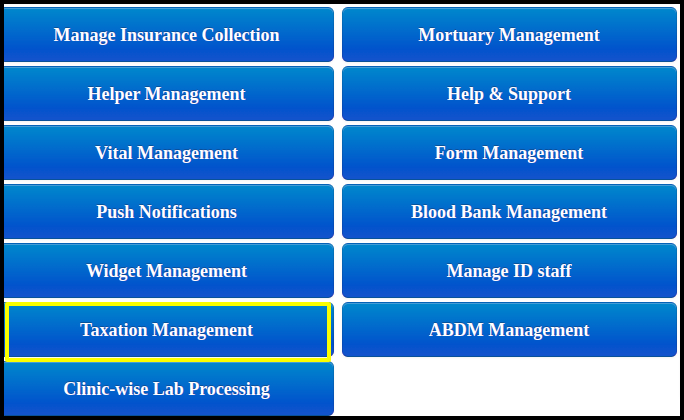

1. Click to Taxation Management from the CPH Dashboard.

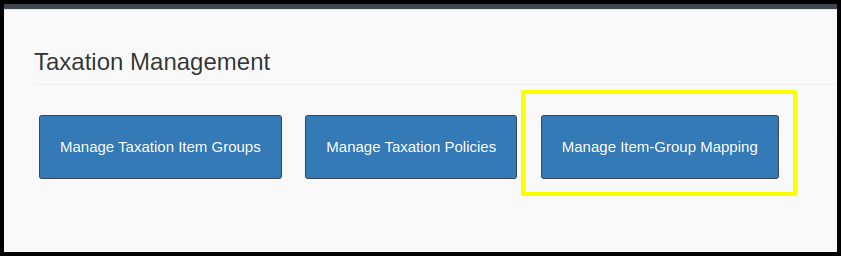

2. Click to Manage Item-Group Mapping from the Taxation Management.

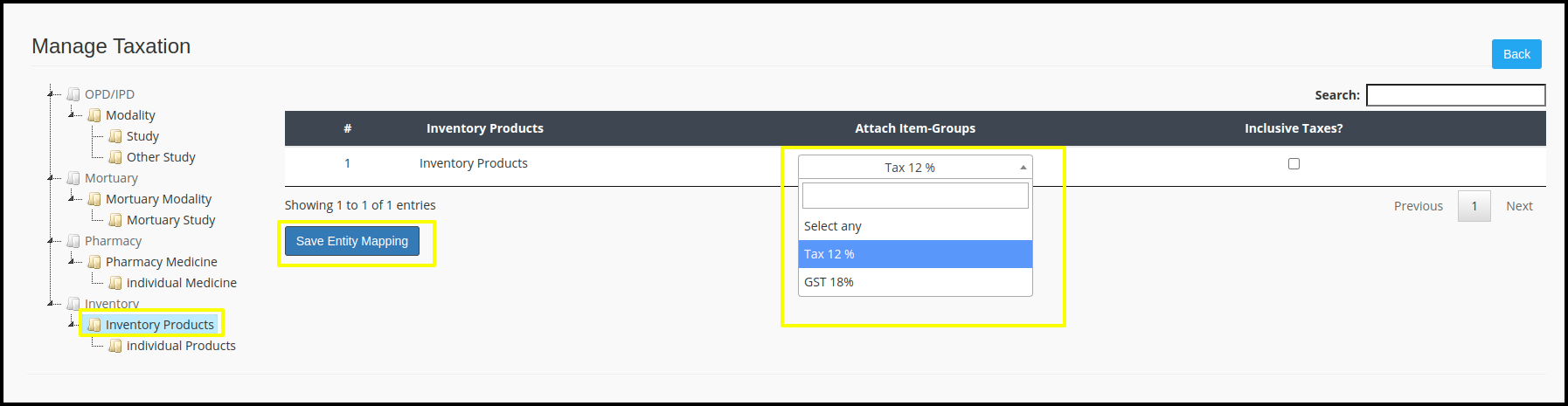

3. Apply the Tax item group on the Inventory

Here you can apply the tax on whole medicine list which is located in the Whole Inventory Product

- Here you can check the Inventory Product list where we can apply the Tax slab.

- Select the whole medical and Non medical group and click to select any box option where you will get the drop down of the Tax group list.

- If want to inclusive the Tax group in the net amount then click to inclusive tax box

- Once you fill up all the details then click to “Save entity Mapping” button to apply on the EHR Side

Or

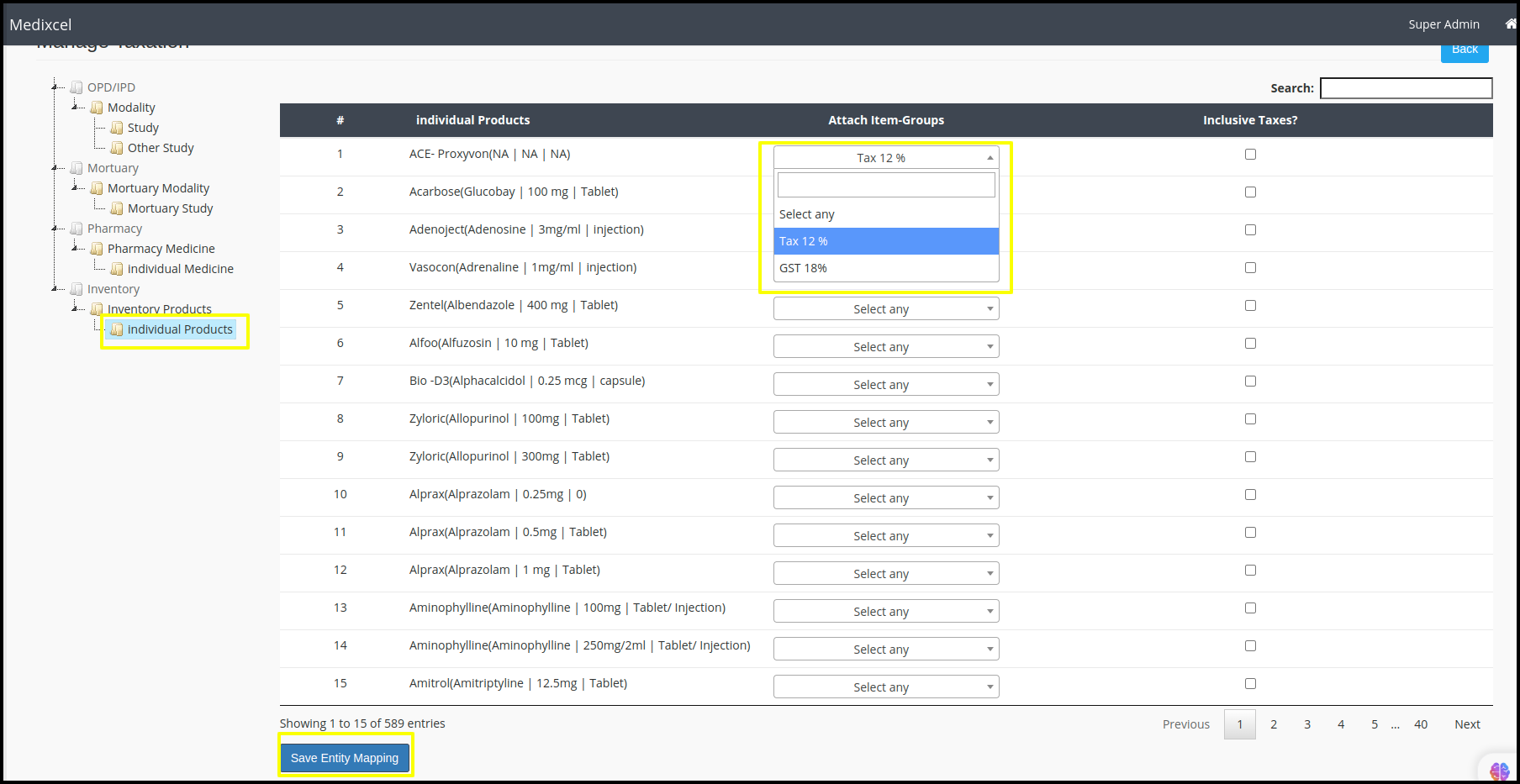

Here you can apply the tax on individual product which is display in the list

- Here you can check the Individual Product list where we can apply the Tax slab.

- Select the Medicine and click to “select any box” option where you will get the drop down of the Tax group list.

- If want to inclusive the Tax group in the net amount then click to inclusive tax box

- Once you fill up all the details then click to “Save entity Mapping” button to apply on the EHR Side